Huggins Co Has Identified an Investment Project

Has identified an investment project with the following cash flows. Has identified an investment project with the following cash flows.

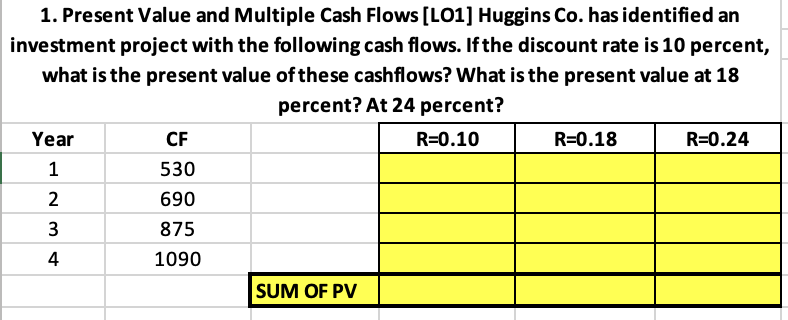

Solved 1 Present Value And Multiple Cash Flows L01 Chegg Com

Year Cash Flow 1 910 2 1310 3 1570 4 1750 If the discount rate is 11 percent what is the present value of these cash flows.

. Has identified an investment project with the following cash flows. Has identified an investment project with the following cash flows. Reported net income of 53000 for 20Y7.

Has identified an investment project with the following cash flows. Has identified an investment project with the following cash flows. 1 790.

Year Cash Flow 1 750 2 990. Has identified an investment project with the following cash flows. Has identified an investment project with the following cash flows if the discount rate is 10 percent what SolutionInn.

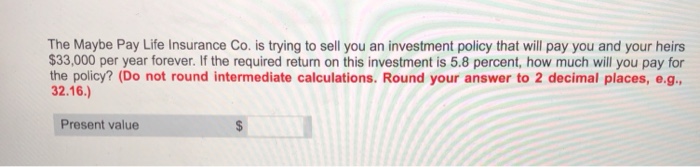

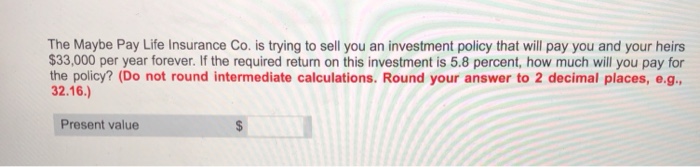

Has identified an investment project with the following cash flows. Terms in this set 10 Huggins Co. Do not round intermediate calculations and round your answer to 2 decimal places eg 3216.

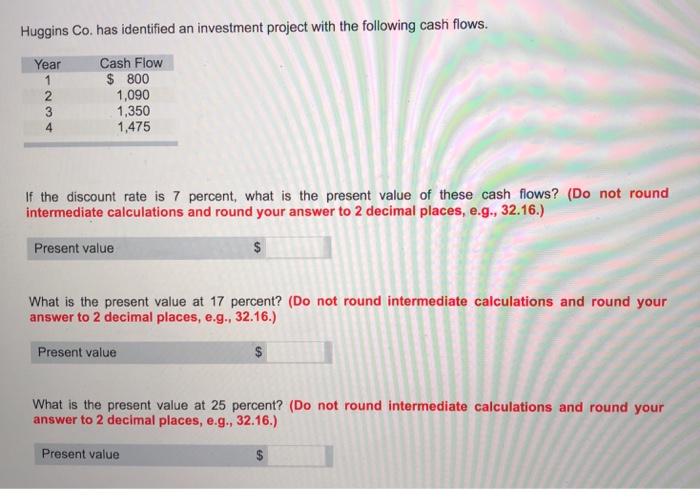

What is the present value at 17. If the discount rate what is the present value of these cash flows. Reported net income of 53000 for 20Y7.

Has identified an investment project with the following cash flows. If the discount rate is 10 percent what is the present value of these flows. This class is NOT easy and Dr.

Havana Inc has identified an investment project with the following cash flows. Has identified an investment project with the following cash flows. If the discount rate is 8 percent what is the present value of these cash flows.

The liability and Takaki Inc. 2500 Posted By. At 24 percent 10 YEAR CASH FLOWS PRESENT VALUE FORMULA USED 1 68000 61818680110 2 81000 66942810121 3 94000 706249401331 4.

The future value FV is important to investors and financial planners as they use it to estimate how much an investment made today will be worth. Answer to Paradise Inc has identified an investment project with the following cash flows. Do not round intermediate calculations and round your answer to 2 decimal places eg 3216 What is the present value at 18 percent.

Year Dont use plagiarized sources. Get Your Custom Essay on Huggins Co. Has identified an investment project with the following cash flows.

Has identified an investment project with the following cash flows. Do not round intermediate calculations and round your answer to 2. What is the present value at 18 percent.

Has identified an investment project with the following cash flows. If the discount rate is 8 percent what is the future value of these cash flows in Year 4. Year Cash Flow 1 730 2 950 3 1210 4 1300 A.

What is the present value at 18 percent. Has identified an investment project with the following cash flows. Present Value and Multiple Cash Flows LO1 Huggins Co.

Has identified an investment project with the following cash flows. Has identified an investment project with the following cash flows. Year Cash Flow 1 780 2 1050 3 1310 4 1425 If the discount rate is 8 percent what is the present value of these cash flows.

Year Cash Flow 1 830 2 1150 3 1410 4 1550 If the discount rate is 8 percent what is the present value of these cash flows. Year Cash Flow 1 830 2 1150 3 1410 4 1550 If the discount rate is 8 percent what is the present value of these cash flows. If the discount rate is 9 percent what is the present value of these cash flows.

02152016 1008 PM Due on. If the discount rate is 10 percent what is the present value of these cash. If the discount rate is 8 percent what is the future value of these cash fl.

Year Cash Flow 1 780 2 1050 3 1310 4 1425 If the discount rate is 8 percent what is the present value of these cash flows. What is the present value at 18 percent. Huggins Co Finance Share With Huggins Co.

Do not round intermediate calculations and round your answer to 2 decimal places eg 3216. Yr 1 800 Yr 2 1090 Yr 3 1350 Yr 4 1475 If the discount rate is 7 what is the present value of these cash flows. Has identified as investment project with the following cash flows.

Do not round intermediate calculations and round your answer to 2 decimal places eg 3216. Has identified an investment project with the following cash flows. Do not round intermediate calculations and round your answer to 2 decimal places eg 3216.

Has identified an investment project with the following cash flows. 03162016 Question 00197816 Subject Finance Topic Finance Tutorials. Do not round intermediate calculations and round your answer to 2 decimal places e.

Problem 6-1 Present Value and Multiple Cash Flows LO1 Huggins Co. YEAR Cash Flow 1 740 2 970 3 1230 4 1325 If the discount rate is 9 percent what is the present value of these cash flows. During the year the company declared dividends of 4000 and issued 1000 shares of common stock for 12 per share.

Answer to Present Value and Multiple Cash Flows Sea born Co. Students also viewed these Cost Accounting questions Huggins Co. If the discount rate is 10 percent what is the present value of these cash flows.

What is the future value at an interest rate of 11 percent. Has identified an investment project with the following cash flows. If the discount rate is 9 percent what is the present value of these cash flows.

Investment X offers to pay you 4700 per year for 9 years whereas Investment Y offers to pay you 6800 per year for 5 years. YEAR Cash Flow 1. The liability and equity accounts from the companys comparative balance sheet are as follows.

If the discount rate is 11 percent what is the present value of these cash flows. This problem has been solved. Hudgins is of little to no help.

Year Cash Flow 1 930 2 1160. Has identified an investment project with the following cash flows. Just from 13Page Order Essay Cash Flow 1 750 2 990 3 1250 4 1350 If the discount rate.

Has identified an investment project with the following cash flows.

Solved Huggins Co Has Identified An Investment Project With Chegg Com

Solved Huggins Co Has Identified An Investment Project With Chegg Com

Huggins Co Has Identified An Investment Project With The Following Cash Flows Year 2 4 Cash Homeworklib

No comments for "Huggins Co Has Identified an Investment Project"

Post a Comment